Not known Facts About Medicare Graham

Table of ContentsThe Ultimate Guide To Medicare Graham6 Simple Techniques For Medicare GrahamAll about Medicare GrahamMedicare Graham Can Be Fun For AnyoneGetting My Medicare Graham To WorkThe Single Strategy To Use For Medicare GrahamHow Medicare Graham can Save You Time, Stress, and Money.The smart Trick of Medicare Graham That Nobody is Talking About

In 2024, this limit was evaluated $5,030. As soon as you and your strategy invest that quantity on Component D medications, you have gone into the donut opening and will certainly pay 25% for medicines going onward. As soon as your out-of-pocket prices get to the 2nd limit of $8,000 in 2024, you are out of the donut hole, and "disastrous insurance coverage" starts.In 2025, the donut opening will be mostly removed for a $2,000 limitation on out-of-pocket Part D medicine investing. As soon as you hit that threshold, you'll pay nothing else expense for the year. If you just have Medicare Components A and B, you may consider supplemental personal insurance policy to assist cover your out-of-pocket costs such as copays, coinsurance, and deductibles.

While Medicare Part C functions as an alternative to your initial Medicare strategy, Medigap interacts with Components A and B and assists fill up in any coverage spaces. There are a few important points to learn about Medigap. Initially, you have to have Medicare Components A and B before acquiring a Medigap plan, as it is a supplement to Medicare and not a stand-alone policy.

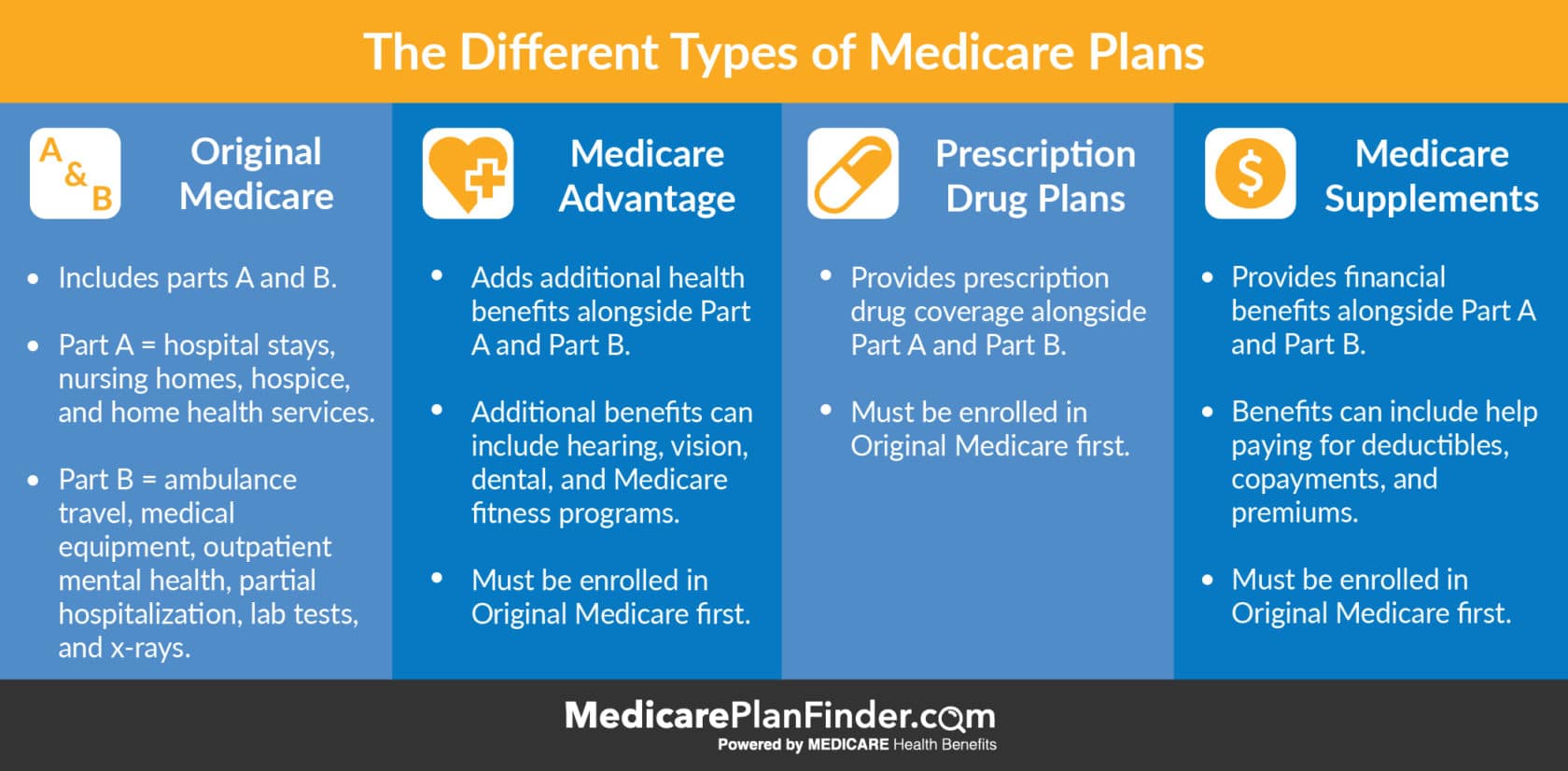

Medicare has advanced for many years and now has 4 parts. If you're age 65 or older and obtain Social Protection, you'll immediately be enrolled in Component A, which covers hospitalization prices. Parts B (outpatient solutions) and D (prescription drug advantages) are voluntary, though under particular scenarios you may be automatically enlisted in either or both of these as well.

An Unbiased View of Medicare Graham

, depending on exactly how many years they or their partner have paid Medicare tax obligations. Personal insurance providers market and provide these policies, yet Medicare needs to approve any type of Medicare Benefit strategy before insurance firms can market it. Medicare does not.

typically cover Usually %of medical costs, prices most plans many strategies need to meet a deductible before Insurance deductible prior to for my blog medical servicesClinical

The costs and benefits of various Medigap plans depend on the insurance coverage company. When an individual begins the policy, the insurance coverage copyright factors their age right into the premium.

Some Known Details About Medicare Graham

The insurer bases the initial costs on the individual's existing age, yet costs rise as time passes. The rate of Medigap intends differs by state. As kept in mind, rates are reduced when a person buys a policy as quickly as they get to the age of Medicare eligibility. Individual insurance coverage business may likewise provide discounts.

Those with a Medicare Advantage strategy are disqualified for Medigap insurance coverage. The time might come when a Medicare strategy owner can no more make their own choices for factors of mental or physical health and wellness. Before that time, the person needs to mark a trusted person to function as their power of attorney.

The individual with power of attorney can pay expenses, file tax obligations, accumulate Social Security benefits, and select or change medical care plans on part of the guaranteed person.

Some Known Incorrect Statements About Medicare Graham

Caregiving is a demanding job, and caretakers often spend much of their time satisfying the requirements of the individual they are caring for.

Depending on the individual state's policies, this may consist of hiring loved ones to give treatment. Considering that each state's guidelines vary, those seeking caregiving payment must look right into their state's demands.

Facts About Medicare Graham Revealed

The cost of Medigap prepares varies by state. As noted, prices are reduced when an individual acquires a plan as quickly as they reach the age of Medicare eligibility.

Those with a Medicare Advantage strategy are disqualified for Medigap insurance policy. The moment may come when a Medicare plan holder can no more make their very own choices for reasons of mental or physical health. Prior to that time, the individual must assign a trusted individual to function as their power of lawyer.

Medicare Graham Things To Know Before You Buy

The individual with power of attorney can pay bills, documents taxes, gather Social Safety and security advantages, and select or change health care strategies on behalf of the guaranteed individual.

Caregiving is a demanding task, and caretakers usually spend much of their time satisfying the requirements of the individual they are caring for.

(https://my.omsystem.com/members/m3dc4regrham)Depending on the individual state's policies, this might include hiring loved ones to give treatment. Considering that each state's laws differ, those seeking caregiving repayment must look into their state's demands.

Comments on “Medicare Graham for Beginners”